Jump to section

Retail stakes have never been higher…don’t get left behind

Q4 2021 looks set to be the most important and eagerly anticipated trading quarters in modern history. Following the restrictions on business due to the global pandemic that has resulted in thousands of brands disappearing from malls around the world, the retail stakes have never been higher. Research conducted by DigitalCommerce360 predicts ‘U.S. consumer spending online to grow 12.1% year over year this 2021 holiday season’, further underlying a renewed consumer confidence and perhaps, a return to the good times.

However, competition for customers online is reaching new heights. Data from Statista for 2020 showed that over 800,000 businesses launched in the US alone. A high number for sure, but in fact it accounts for just 10.7% of the world’s start ups last year. In a marketplace with no borders and boundaries competition comes from everywhere and anywhere.

Having access to precise comprehensive data with full search page visibility is no longer a ‘nice to have’. It is now an essential tool for retailers trying to compete in high stakes online advertising. The ability to make more effective campaign decisions and simply compete relies on making moves where other retail advertisers have missed out or are late to the party. We DO NOT suggest reliance on guesswork which has never made for a good strategy.

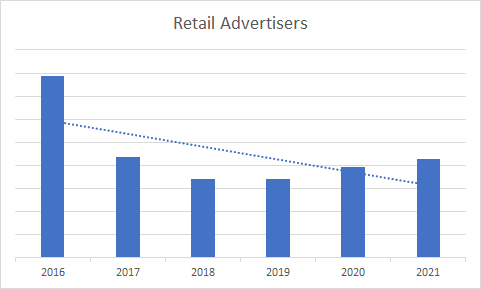

Recent data from The Search Monitor shows that there are opportunities to be had in paid text ads that most retailers are missing. The diagram below shows that the number of Retail advertisers using PPC text ads has been trending down since 2016 as dollars were rapidly shifted to shopping / PLA ads across multiple retail categories. This indicates that there are cheaper keyword alternatives now available on the PPC side that most retailers have overlooked.

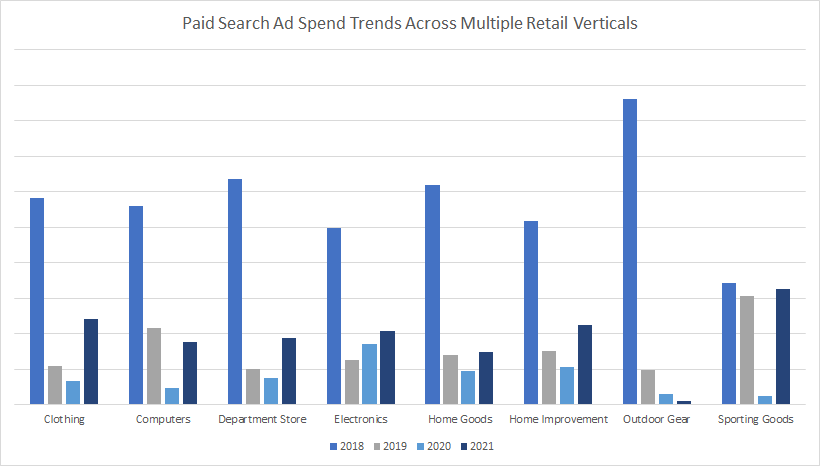

The diagram below shows that US ad spend on Paid Search trends down by retail vertical from 2018 – 2021. We can also see that in some categories, such as Sporting Goods, perhaps some retailers are starting to catch onto the fact that there are opportunities in paid text ads. We highly recommend that Retailers quickly adapt to ppc opportunities, using a blended mix of shopping and ppc text ads to drive consumers to their products.

So, it’s clear that there are real opportunities for retail advertisers to grab market share in Q4 2021 and into the new year. It requires a blended approach that optimizes shopping ad placements while seizing opportunities where there is a lack of text ad competition to steal market share and customers. More importantly, it requires forward thinking marketers to have access to critical paid search intelligence and spot the opportunities that exist and chart a course to success.

In recent weeks, the global leader in competitive intelligence, The Search Monitor, have released a slew of PLA and Retail enhancements to enable marketers to take control of their business and take advantage of their peak period:

- Sellers Snapshot allows advertisers to see all competitors’ product listings along with max/min prices, and the ability to set competitive pricing that wins the click.

- Enhanced Keyword Coverage determines which words are triggering shopping and text ads, and where you and your competitors have coverage gaps.

- Share of Voice (SOV) Alerts enable users to receive a real-time SmartAlert™ when their PLA SOV increases or drops on their ads and competitors’ products.

These new additions help brands dominate the search marketplace with global visibility across paid ads, organic, and shopping listings. Together with SERP Share reports, visibility scoring, and keyword customizations, these new PLA enhancements add even more tools to retail customers’ toolkits, and turn brand defense into business offense.

The stakes for retail business have never been higher. Opportunities exist for a nuanced approach to text & PLA activities. Don’t get left behind.

Learn more about PLA monitoring and other features by visiting: https://www.thesearchmonitor.com/products/ or by talking to the team directly, at sales@thesearchmonitor.com

Share on Social

See Our Data at Work

Provide us with a competitor’s website, a set of keywords, or one of our 1,000+ verticals, and we’ll show you the power of our monitoring capabilities. Request a personalized demo today and see what our insights can do for you!

Trusted by

Brand Protection

Brand Protection SEM Insights

SEM Insights Affiliate Compliance

Affiliate Compliance Ad Armor

Ad Armor Learning Center

Learning Center Guides & Webinars

Guides & Webinars We Love Data™

We Love Data™ About Us

About Us Our Data

Our Data Careers

Careers Our Team

Our Team News

News Contact Us

Contact Us