Customize My Results

Configure the Crawler

Configure the Crawler

Send My Ad Activity

This website uses advertising and analytics technologies (including cookies from your device) to measure advertising effectiveness and/or to improve the browsing experience.

By clicking 'Continue to Site', you consent to our use of advertising and analytics technologies (including cookies from your device).

You can unsubscribe to our communications using the unsubscribe link provided in email communication.

A link to our privacy policy can be found in the footer of this website.

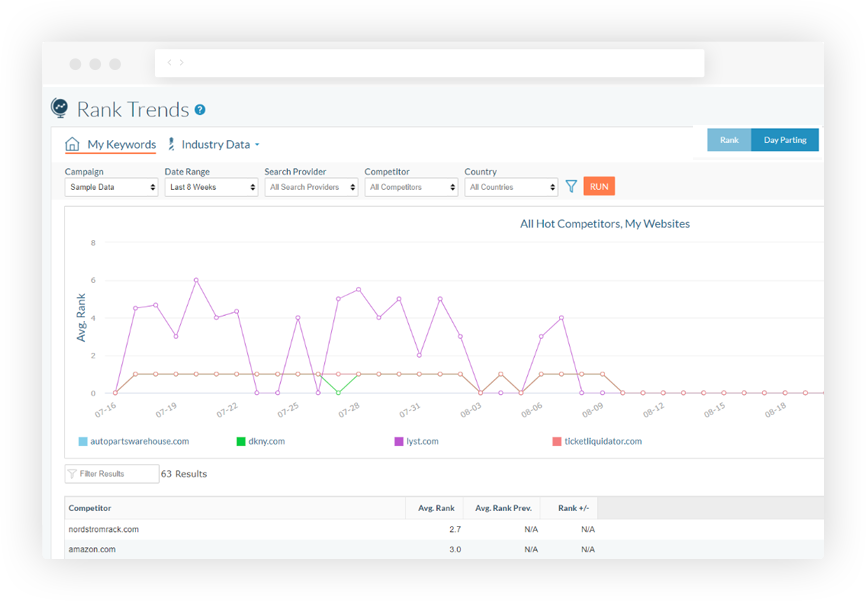

: Enforce co-operative rank bidding rules with resellers and competitors. Learn about Super Affiliate strategies.

We’re built and supported by a team of experts. Together let’s spend 15 minutes and give you a live demo of how The Search Monitor will help protect your brand and provide competitive insights.

Work in the higher-education industry and looking for competitive advertising insights? One of our higher-education clients, Fathom Advertising..

“We switched to The Search Monitor from another provider, and couldn’t be happier. The platform is easy to navigate and has all of the great data that we need. The support team has been responsive and helpful. We are really happy so far that we made the switch.”

“We believe in the power of competitive intelligence and we’re excited to partner with The Search Monitor to bring a robust solution to our clients.”

“The main reason we started using The Search Monitor was to easily track and take action on unauthorized ads & Trademark use. In that respect it has become invaluable. What used to take an employee hours a week is now done automatically with even more detail and accuracy than we could ever have imagined. Our process has become much more efficient and effective by using The Search Monitor.”

“We have been using The Search Monitor for over 10 years in the USA, Europe, and other parts of the globe to support our clients’ search campaigns. The Search Monitor is a great all-around platform that includes SEM, SEO, and PLA insights all in one place.”