Three key data points on why the Gym market is heating up in North America

Feb 15, 2022

Agencies, Marketing Teams, We LOVE Data™

It’s that time of the year when millions of people around the world decide to motivate themselves, dust off their sweatpants and get back to the gym. So this year we wanted to see if the data is reflecting a shift from more ‘at-home’ workouts to people heading back to the gym in-person. Is there a growing confidence to get back to public gyms as lockdown measures ease in the United States?

It’s that time of the year when millions of people around the world decide to motivate themselves, dust off their sweatpants and get back to the gym. So this year we wanted to see if the data is reflecting a shift from more ‘at-home’ workouts to people heading back to the gym in-person. Is there a growing confidence to get back to public gyms as lockdown measures ease in the United States?

Using The Search Monitors Lighthouse™ data*, we pulled SERP Share data as well as ad spend and competitive data to discover the detail.

1. Fitness brands are staying in their lane…for now.

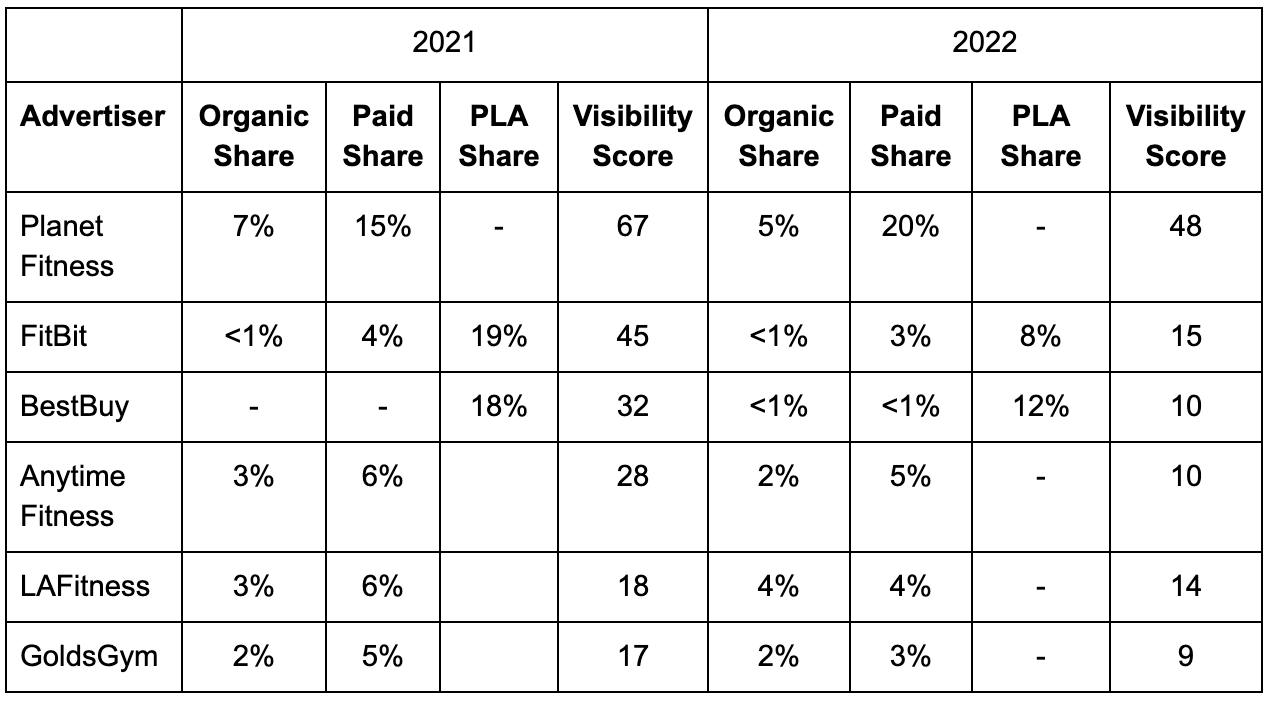

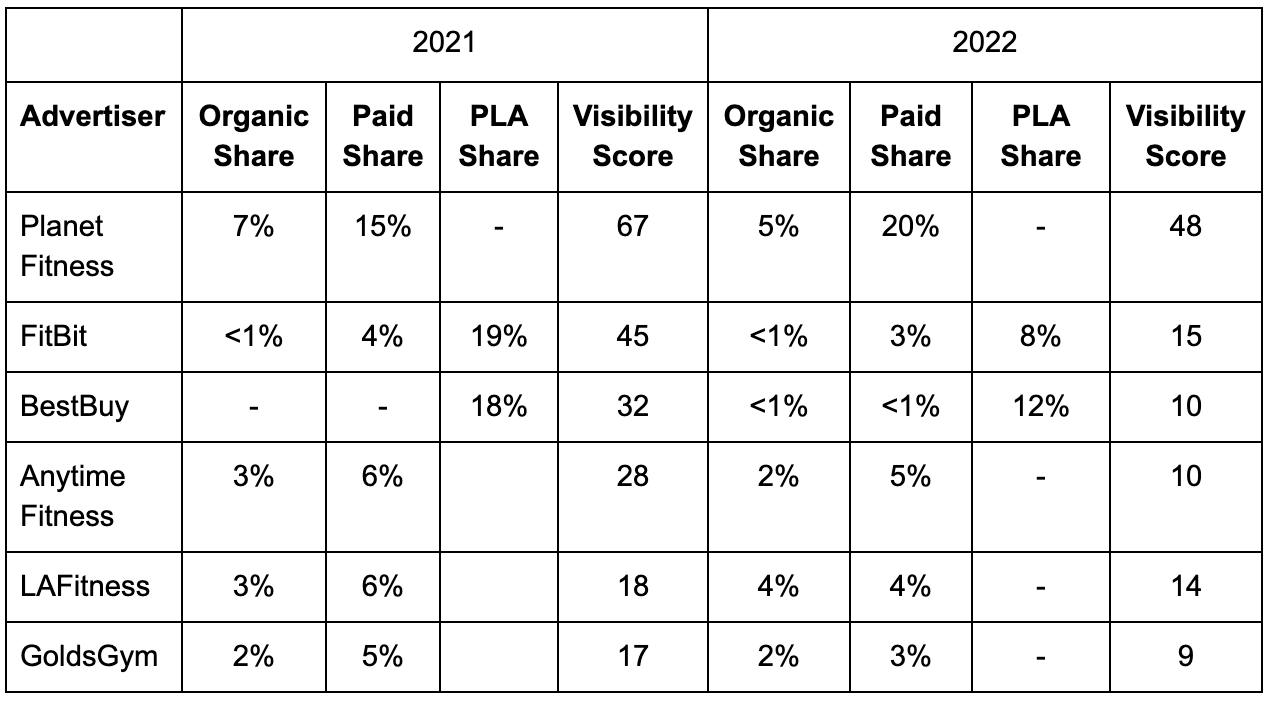

The table above shows trends around the different strategies utilized by at-home gym companies and brick and mortar gyms. As you would expect, Home Gym brands emphasize a focus on dominating PLA share and brick and mortar gyms on paid placements to gain visibility. Will Home Gym brands look to increase their SERP visibility and dominate the page by competing for paid placements in the coming months and challenging the dominance of brands like Planet Fitness?

2. Demand is high for brick and mortar gyms right now.

In comparing 2022 to 2021, we noticed a much larger increase in ad spend from brick and mortar gyms, with some brands ramping up their spend considerably:

This increase in ad spend indicates that gyms are ready for a comeback to in-person workouts and the industry’s confidence in where things are headed post-pandemic in the United States. Brands in this space will need to monitor their competitors closely and look for geo-targeting opportunities to engage their customers at a local level where the numbers of competing brands may be smaller and personalization can be applied to greater effect.

3. New entrants are swelling the market

Data from 2022 shows that the market size has swelled by almost one-fifth, with 17.5% more advertisers bidding on gym membership keywords than the year before. New market entrants will no doubt be trying to steal brand traffic from the established players to gain traction and win new customers. Mature brands in the space need to ensure that they have a solid brand protection strategy in place to ensure their market share does not become eroded and infringed in the coming months.

The gym market is hotting up. More brands are launching, capturing more market from the established players amid an increase in consumer confidence. More now than ever, brands in this space will need to protect their terms and market share to ensure that new entrants do not gain traction at their expense. The old adage ‘what you cannot see you cannot measure’ is truer in PPC today than ever before. Don’t get left behind, contact us or set up a demo and we'll show you the data for your industry and competitors.

We LOVE Data™ is a research series published by The Search Monitor to provide industry insights for online advertising activity on search engines and other online marketing channels.

* The Search Monitor’s Marketing Visibility Score™ (SMVS) measures a company’s search presence across the entire results page—Paid, Organic, and Product Listing Ads (PLA)—adjusted for a company’s specific competition.

Using The Search Monitors Lighthouse™ data*, we pulled SERP Share data as well as ad spend and competitive data to discover the detail.

- Date range: January 2021 & January 2022

- Engines: Google & Google Mobile

- Keyword groups: Gyms & Gym Memberships

- Location: USA

Here are 3 key observations we have learned.

1. Fitness brands are staying in their lane…for now.

The table above shows trends around the different strategies utilized by at-home gym companies and brick and mortar gyms. As you would expect, Home Gym brands emphasize a focus on dominating PLA share and brick and mortar gyms on paid placements to gain visibility. Will Home Gym brands look to increase their SERP visibility and dominate the page by competing for paid placements in the coming months and challenging the dominance of brands like Planet Fitness?

2. Demand is high for brick and mortar gyms right now.

In comparing 2022 to 2021, we noticed a much larger increase in ad spend from brick and mortar gyms, with some brands ramping up their spend considerably:

- PlanetFitness +113%

- Anytime Fitness +57%

- 24Hour Fitness +54%

- Golds Gym + 16%

This increase in ad spend indicates that gyms are ready for a comeback to in-person workouts and the industry’s confidence in where things are headed post-pandemic in the United States. Brands in this space will need to monitor their competitors closely and look for geo-targeting opportunities to engage their customers at a local level where the numbers of competing brands may be smaller and personalization can be applied to greater effect.

3. New entrants are swelling the market

Data from 2022 shows that the market size has swelled by almost one-fifth, with 17.5% more advertisers bidding on gym membership keywords than the year before. New market entrants will no doubt be trying to steal brand traffic from the established players to gain traction and win new customers. Mature brands in the space need to ensure that they have a solid brand protection strategy in place to ensure their market share does not become eroded and infringed in the coming months.

The gym market is hotting up. More brands are launching, capturing more market from the established players amid an increase in consumer confidence. More now than ever, brands in this space will need to protect their terms and market share to ensure that new entrants do not gain traction at their expense. The old adage ‘what you cannot see you cannot measure’ is truer in PPC today than ever before. Don’t get left behind, contact us or set up a demo and we'll show you the data for your industry and competitors.

We LOVE Data™ is a research series published by The Search Monitor to provide industry insights for online advertising activity on search engines and other online marketing channels.

* The Search Monitor’s Marketing Visibility Score™ (SMVS) measures a company’s search presence across the entire results page—Paid, Organic, and Product Listing Ads (PLA)—adjusted for a company’s specific competition.