The CFPB issues another warning to credit card marketers

Sep 13, 2014

Finance & Insurance

Credit Card Marketers: Are you carefully monitoring your marketing materials and those of your partners? If not, the Consumer Financial Protection Bureau might want to have a talk with you about some money you owe them.

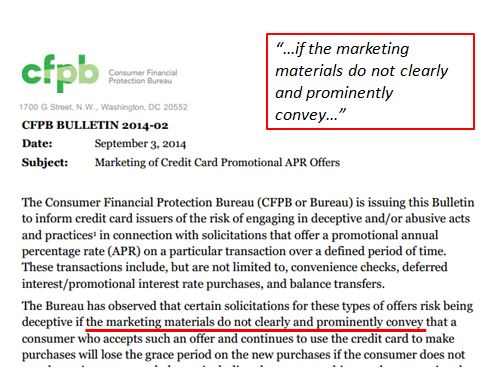

The CFPB issued a bulletin on September 3, 2014 to credit card marketers outlining the risks associated with deceptive marketing tactics when promoting their services. Deceptive tactics include using incorrect language in ads as well as leaving required language out of ads, such as the costs and limitation of certain sign-up offers.

This is not a new initiative for the CFPB. The rules governing the language used by these marketers were outlined in Section 1031 of the Dodd-Frank Act signed into law in July 2010. Since then, the CPFB has been very active since then in pursuing legal action and fines against what they feel is deceptive and abusive marketing practices.

See our previous blog post on the CARD Act for examples of fines levied on credit card companies in 2012 and 2013.

Questions to ask yourself:

Credit Card Marketers: Are you carefully monitoring your marketing materials and those of your partners? If not, the Consumer Financial Protection Bureau might want to have a talk with you about some money you owe them.

The CFPB issued a bulletin on September 3, 2014 to credit card marketers outlining the risks associated with deceptive marketing tactics when promoting their services. Deceptive tactics include using incorrect language in ads as well as leaving required language out of ads, such as the costs and limitation of certain sign-up offers.

This is not a new initiative for the CFPB. The rules governing the language used by these marketers were outlined in Section 1031 of the Dodd-Frank Act signed into law in July 2010. Since then, the CPFB has been very active since then in pursuing legal action and fines against what they feel is deceptive and abusive marketing practices.

See our previous blog post on the CARD Act for examples of fines levied on credit card companies in 2012 and 2013.

Questions to ask yourself:

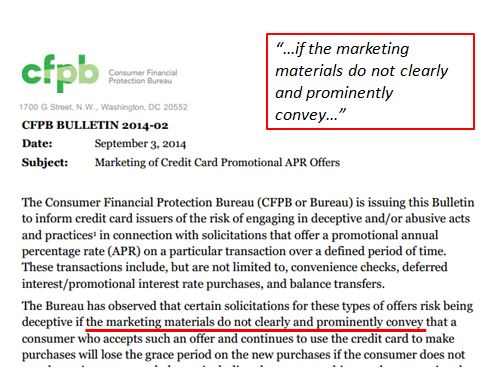

Click image to read CFPB Bulletin[/caption]

Click image to read CFPB Bulletin[/caption]

Credit Card Marketers: Are you carefully monitoring your marketing materials and those of your partners? If not, the Consumer Financial Protection Bureau might want to have a talk with you about some money you owe them.

The CFPB issued a bulletin on September 3, 2014 to credit card marketers outlining the risks associated with deceptive marketing tactics when promoting their services. Deceptive tactics include using incorrect language in ads as well as leaving required language out of ads, such as the costs and limitation of certain sign-up offers.

This is not a new initiative for the CFPB. The rules governing the language used by these marketers were outlined in Section 1031 of the Dodd-Frank Act signed into law in July 2010. Since then, the CPFB has been very active since then in pursuing legal action and fines against what they feel is deceptive and abusive marketing practices.

See our previous blog post on the CARD Act for examples of fines levied on credit card companies in 2012 and 2013.

Questions to ask yourself:

Credit Card Marketers: Are you carefully monitoring your marketing materials and those of your partners? If not, the Consumer Financial Protection Bureau might want to have a talk with you about some money you owe them.

The CFPB issued a bulletin on September 3, 2014 to credit card marketers outlining the risks associated with deceptive marketing tactics when promoting their services. Deceptive tactics include using incorrect language in ads as well as leaving required language out of ads, such as the costs and limitation of certain sign-up offers.

This is not a new initiative for the CFPB. The rules governing the language used by these marketers were outlined in Section 1031 of the Dodd-Frank Act signed into law in July 2010. Since then, the CPFB has been very active since then in pursuing legal action and fines against what they feel is deceptive and abusive marketing practices.

See our previous blog post on the CARD Act for examples of fines levied on credit card companies in 2012 and 2013.

Questions to ask yourself:

- Do you have a way to monitor how your marketing copy appears to consumers after it leaves your marketing department? For example, if you agency leaves out certain APR terms, your ads may be in violation of CFPB rules

- Do you have a way to monitor how your affiliate marketers promote your services to their audiences?

Click image to read CFPB Bulletin[/caption]

Click image to read CFPB Bulletin[/caption]