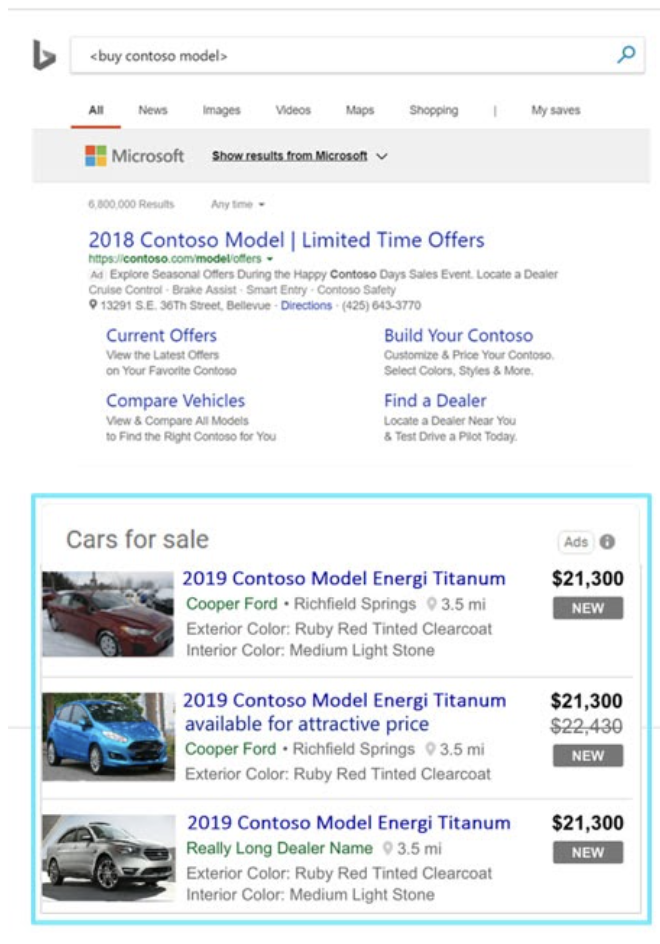

In the Spring of 2021, Google and Bing announced a new ad format—Vehicle Listing Ads (VLAs). These feed-based product ads (similar to Product Listing Ads for retail) allow automotive dealerships to expand their reach and conversions. By simply uploading their inventory (make, model, year, etc.) their listings will be served up on Google and Bing search results and give the buyer a better search result and jumping off point.

They also give automotive marketers the ability to own more of the SERP—every advertiser’s dream come true. And, as we have learned with every industry, the more data available around competition and ad performance, the better decisions marketers are able to make, if they can access it.

Brand protection is essential for PPC success.

Brand protection is essential for PPC success.